January 16, 2013

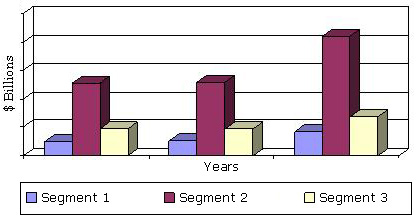

Wellesley, Mass. – The total global surveillance and security market generates revenues of approximately $81 billion per year. Individual country markets are growing in the range of 7% to 9% per year depending on the exact locale. The three major end-user segments for equipment are industrial and commercial purchasers (nearly $52 billion per year); noncommercial applications, which consist of principally equipment sales for residential surveillance and security ($19 billion per year); and military/government (nearly $11 billion).

Equipment sales to industrial and commercial users are growing the fastest due to the potential for economic savings due to less theft. Equipment adoption in industrial/commercial settings is also being spurred on by the fact that equipment is becoming much more sophisticated and capable, so the value to the enterprise is becoming clearer.

Sales to the residential sector are growing slightly slower than sales to governments due to the fact that residential sales depend on growth in disposable income, and growth in that sector continues to slow when compared historically, particularly in Europe during the early years of this report’s forecast period. Government and military expenditures are not nearly as constrained, and growth there is also being driven by the simple fact that surveillance technologies have become so sophisticated, and thus efficacious, that somehow room in budgets is made for them.

Related areas, such as the overall enterprise IT security market, point to an even larger market. Such expenditures (not included in the $81 billion figure above) amount to about $20 billion per year. The secure content management market, which includes antivirus, web filtering, and messaging security, is an $8 billion-a-year market.

Surveillance and Security Equipment: Technologies and Global Markets (SAS015B) will help its readers:

Surveillance and Security Equipment: Technologies and Global Markets( SAS015B )

Publish Date: Jan 2013

Data and analysis extracted from this press release must be accompanied by a statement identifying BCC Research LLC as the source and publisher. For media inquiries, email press@bccresearch.com or visit www.bccresearch.com/media to request access to our library of market research.