February 12, 2015

Wellesley, Mass., February 12, 2015 –BCC Research (www.bccresearch.com) reveals in its new report on building-integrated photovoltaics (BIPV), the photovoltaics (PV) industry is making the transition from an expensive renewable technology to becoming a major factor in the world’s energy supply. Revenue to PV manufacturers for capacity devoted to BIPV products will increase from a little over $1.4 billion in 2014 to close to $2 billion in 2019. This revenue gain will occur despite steadily falling prices for PV power-generating capacity.

Façades are the most significant market segment in 2014 and will maintain that position through 2019. The BIPV glazing and standing seam metal roof segments will also experience large market expansions. The fastest-growing segments will be solar roof tiles and skylights.

Smart minds and technological innovation have expanded the opportunities for crystalline (c-Si) and polycrystalline silicon (poly-Si) modules to enter the BIPV space. The big advance has been thinner cells, lighter modules and the ability to incorporate hard surfaces into standard-sized external building components such as roof tiles, cladding, curtain walls, windows, skylights, breezeways and so on.

The ability for architects, real estate developers and building component manufacturers to offer a premium product is welcome as an added market opportunity when the global building construction and renovation industries are struggling to emerge in a sustainable manner from a global downturn everywhere except in oil- and gas-rich countries. A great exception to this is China, which is now (among many other activities) building infrastructure in the hinterlands and offshore, and continually accumulating a globally dominant national photovoltaic manufacturing capability.

Some recovery is occurring in the new and renovated commercial and industrial building markets in the U.S., Brazil, the wealthier countries in the E.U., the Middle East, Asia Minor and Southeast Asia (particularly Indonesia and Singapore). Weak and incomplete grids in India make a strong case of bringing PV into the building components arena because dense population centers are vulnerable to power interruptions.

Japan is another strong PV opportunity as the country furiously drives to replace its nuclear fleet of power plants with a country-wide renewables infrastructure in the face of the continuing catastrophe at the Daichi nuclear plant.

“In these tightened market conditions, the ability of PV manufacturers to mass produce solar materials to bring down costs is paramount to be competitive and to survive,” says BCC research analyst Michael Kujawa. “The PV world in general is maturing as the price of capacity approaches grid parity. To succeed in the BIPV universe, costs meet with concepts of compatibility with national economies, building structure, aesthetics and public support systems.”

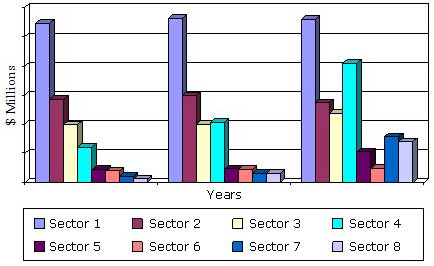

Building-Integrated Photovoltaics (BIPV): Technologies and Global Markets examines the global BIPV industry and trends in the evolution of the various BIPV market segments. The markets are characterized in terms of present and future (through 2019) generating capacity and dollar value of PV systems shipped for BIPV applications.

Editors and reporters who wish to speak with the analyst should contact Steven Cumming at steven.cumming@bccresearch.com.

Building-Integrated Photovoltaics (BIPV): Technologies and Global Markets( EGY072B )

Publish Date: Dec 2014

Data and analysis extracted from this press release must be accompanied by a statement identifying BCC Research LLC as the source and publisher. For media inquiries, email press@bccresearch.com or visit www.bccresearch.com/media to request access to our library of market research.