Battery Energy Storage System Market

Forecast-backed insights for confident investment decisions.

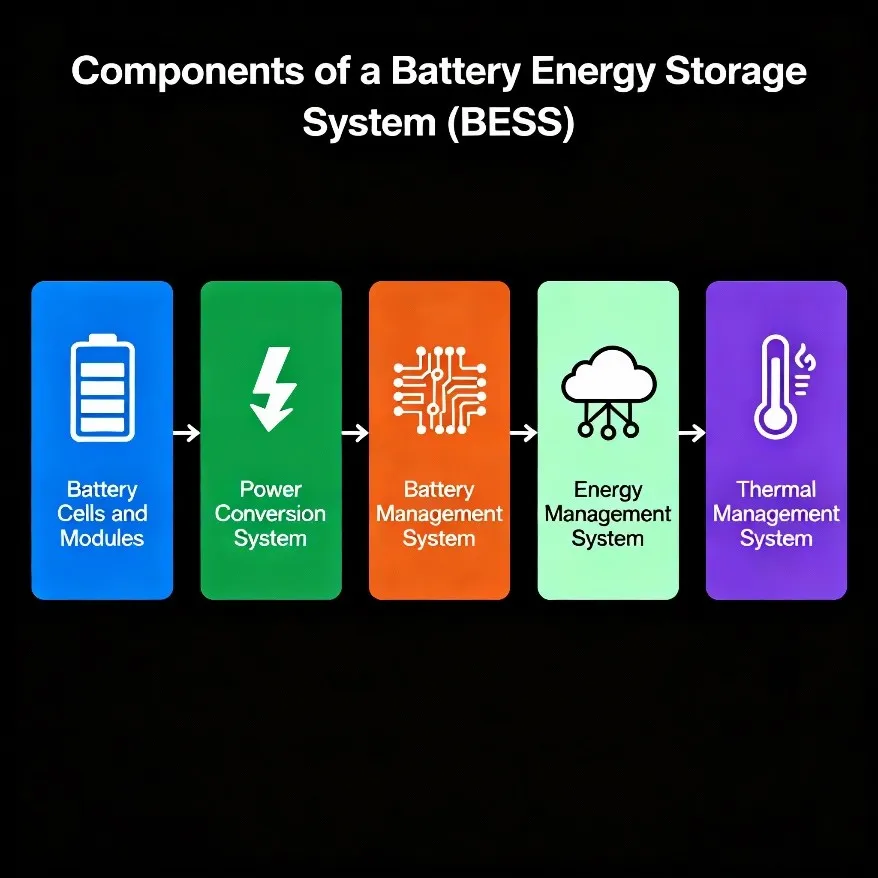

Battery energy storage systems comprise two electrodes separated by an electrolyte and are classified under electrochemical energy systems. In a battery energy storage system, the chemical energy stored in it is transformed into electrical energy and vice versa during the charging process. Battery energy storage system components primarily consist of batteries, a power conditioning system (C-PCS), a control system and a protection system. Compared to techniques such as pumped hydro, compressed air and flywheel energy storage, batteries provide an ideal and compact solution for electrical energy storage.

According to the Journal of Energy Storage, in power system applications, a deep-cycle battery with an efficiency of approximately 80% is the most widely used type of battery. Various types of battery energy storage systems include lithium-ion, sodium-ion, zinc-air, lead-acid, flow, solid-state and nickel-cadmium batteries. Several types of battery energy storage system technologies are deployed at various levels within the electricity network for different applications, including peak shaving, energy arbitrage, power ramp control, power backup, frequency regulation and mitigating power scheduling mismatch penalties.

Fig 1: Components of a Battery

Energy Storage System

Key Market Insight: “According to the International Renewable Energy Agency, among different types of battery energy storage systems, Li-ion is the most dominant with approximately 90% of the total market share in 2023. This growth of Li-ion battery energy storage systems is due to the high energy density, long life cycle, high efficiency and low maintenance of Li-ion batteries.”

Evolution:

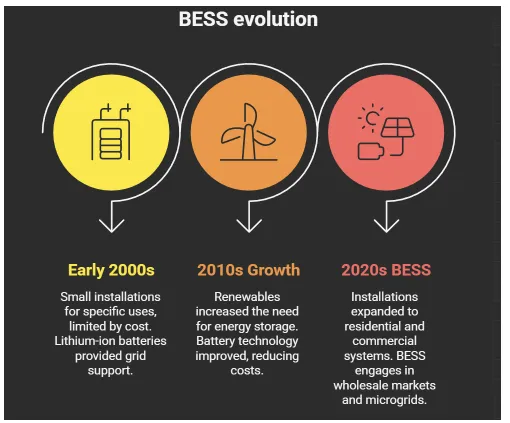

Fig 2: Evolution of Battery

Energy Storage Systems

Early 2000s: BESS installations were relatively small in scale and primarily targeted specific uses, such as emergency power for essential facilities. Lithium-ion batteries, the leading technology due to their high energy density, were costly, limiting their broad acceptance. Batteries primarily provided fundamental grid support services, such as frequency regulation.

Growth of Renewables in the 2010s: The rise of solar and wind energy emphasized the necessity for energy storage to manage their irregularity. Improvements in battery technology resulted in considerable cost reductions, enhancing the commercial viability of lithium batteries and allowing them to play a broader role in the grid, such as peak shaving, energy arbitrage and deferral of transmission.

BESS during the 2020s: BESS installations are no longer limited to utility-scale; residential and commercial systems are increasingly becoming popular. BESS is expanding past conventional grid services, engaging in wholesale markets, and offering flexibility for microgrids. Novel battery technologies offer the potential for greater energy density and reduced expenses.

Current Market Scenario and Challenges:

In today’s constantly changing world, there is a growing demand for efficient, reliable and sustainable energy solutions. Battery energy storage system technologies have emerged as vital enablers of this energy revolution. It bridges the gap between energy production and consumption. Battery energy storage systems are widely used as they offer backup power during blackouts, thereby contributing to grid reliability. Furthermore, energy storage systems have various applications, such as electrical grid stabilization, providing power backup, facilitating the charging of electric vehicles and optimizing energy consumption in commercial and industrial settings.

Battery energy storage systems provide crucial solutions for managing power demand and enhancing the efficient usage of sustainable resources. However, a major challenge for battery energy storage systems is that they require significant investments in procuring inverters, batteries and control systems. Investments in infrastructure are necessary for integrating battery energy storage systems with currently operating grids. This includes preparing the site, installing safety systems and building interconnection structures. Besides, the high cost of energy storage batteries can create financial barriers to large-scale implementation. These costs and huge investments slow down the widespread acceptance of battery energy storage systems compared to cheaper traditional options.

Key Manufacturers:

Some of the key manufacturers operating in the battery energy storage system market include Hitachi, ABB, JAKSON, Toshiba Corporation, TotalEnergies, General Electric, Schneider Electric, Siemens Energy, Panasonic Holdings Corporation, BYD Company, Exide Industries, Okaya Power Group, CATL (Contemporary Amperex Technology Co. Limited), NextEra Energy Resources, VARTA AG, Fluence and Honeywell.

Key Developments:

- In May 2025, ABB announced the launch of its new BESS-as-a-Service, which is a flexible, zero-CapEx solution. It is primarily produced to facilitate the shift to resilient, clean and affordable energy. BESS-as-a-Service is the first next-generation service model designed to accelerate the transition of industries to net zero. This strategy will reduce adoption hurdles, facilitating scalable implementation, enhancing the integration of renewable energy sources and fostering the expansion of the global battery energy storage system market.

- For the promotion of a transparent and sustainable battery sector, Siemens Energy complies with the EU Battery Passport Regulation, which is a digital record that encourages supply chain transparency. It also offers reuse and recycling throughout a battery's lifecycle. The company ensures regulatory compliance and supports its customers' sustainability objectives by incorporating these into its Qstor solutions. Qstor solutions are based on proven power electronics to shape the future grids.

- The UK government predicts that battery storage system technologies incorporating more low-carbon power, heat and transport technologies can save the UK energy system up to $48 billion by 2050, thereby lessening energy bills. This will help reduce costs, enhance efficiency and affordability, thereby driving stronger adoption of battery energy storage systems.

- According to REN21, in 2023, Hungary announced a $337 million investment for promoting the construction of utility-scale battery storage for over 10 years. According to the International Energy Agency, Spain offered $166 million in subsidies for approximately 30 battery storage system projects combined with sustainable energy power facilities. The Spanish government also announced approximately $300 million in grants for thermal energy storage, stand-alone battery storage, and pumped storage projects.

- According to the Institute for Energy Economics and Financial Analysis (IEEFA), India is consistently growing battery storage and renewable energy (hybrid) tenders. Due to the increasing demand for renewable energy, the share of hybrid tendered capacity surged to 49% in 2024, compared to 12% in 2021, in the overall sustainable energy tenders.

- The European Commission, in March 2023, released regulations on energy storage, aimed at offering the implementation of energy storage systems across Europe. In 2024, Italy released a set of new regulations on the Electric Storage Capacity Procurement Mechanism. This is anticipated to foster large-capacity auctions for power-to-gas storage as well as grid-scale battery storage.

Investments:

Energy Transition Investment Trends 2024 reports that investment in battery storage across the globe continued its notable growth trend, growing 76.8% in 2023 to reach approximately $36 billion. Global investment in the energy transition reached a record $1.8 trillion in 2023, representing a 17% increase from 2022. China accounts for 38% of the global total, at $676 billion, and remains the leading contributor to energy transition funding.

Future Outlook:

Battery energy storage system technologies will play a crucial role in enabling a more resilient grid by facilitating the integration of distributed energy resources. There is a growing focus on producing more renewable and ethical battery materials, as well as recycling, to reduce environmental impact. They can help to achieve a sustainable and clean energy future with constant innovation and government support.

Looking for Consulting & Advisory Projects