Cold-Chain and Traceability Solutions for Biologics and Vaccines

In-depth market intelligence to support growth and planning.

Current Market Trends

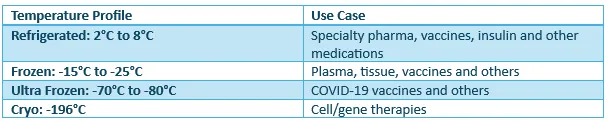

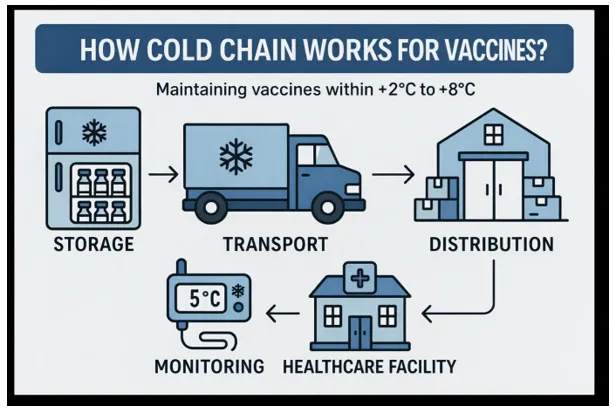

- Digitization and real-time monitoring: Markets for cold-chain monitoring and real-time visibility solutions are growing double-digits, driven by regulatory requirements and demand for continuous data, including temperature, location and shock. For example, in September 2025, Tive partnered with AstraZeneca FluMist Home to insert its Tive Tag on each at-home FluMist vaccine shipment so the recipient can confirm in-transit temperature compliance via phone scan - practical proof of consumer-level, real-time monitoring.

- Unit-level serialization and scanning: The Drug Supply Chain Security Act (DSCSA) in the United States started its serialized interoperable item-level phase (2023 onward) while stakeholders exchanged Electronic Product Code Information Services (EPCIS) events through GS1-specified 2D barcodes. The Centers for Disease Control and Prevention (CDC) supports using GS1-based 2D barcodes for vaccine tracking to achieve precise administration data capture.

- Anti-falsification and supply integrity: WHO and partners warn that substandard/falsified medical products persist in low- and middle-income countries. Traceability (serialization, verification) is a critical countermeasure embedded in global and national strategies. In July 2025, Antares Vision Group (rfxcel) partnered with LedgerDomain to harden DSCSA compliance and system security (credentialing, tamper resistance) - directly aimed at preventing illegitimate product entry.

- Platform innovations: WHO/Gavi prequalify and guide the adoption of solar direct-drive (SDD) refrigerators and advanced passive devices to harden last-mile reliability. The latest performance, quality and safety (PQS) program and cold chain equipment (CCE) guidance stress temperature performance, autonomy (≥3 days), and reduced freeze risk. Sustainability (solarization) is now a practical cold-chain lever, not just a pilot. For example, in February 2024, in order to give end-to-end insight over the vaccine path from manufacture to patient, Controlant created Saga Card in partnership with other partners. The new, tiny IoT gadget is a big improvement over the pallet-level real-time visibility available today. It will offer real-time visibility at the national, regional and local levels, down to secondary packaging such as cases and cartons, when paired with Controlant's platform.

Market Players

|

Company |

Description |

|

Berlinger

& Company (acquired by Sensitech) |

The company offers fridge-tag®

for continuous monitoring of sensitive vaccines stored in medical

refrigerators and freezers for up to three years.

In August 2024, Carrier’s

Sensitech acquired the Monitoring Solutions business of Berlinger &

Company, which specializes in innovative and customized solutions for

monitoring temperature-sensitive goods in the pharmaceutical and life

science, clinical trial, and global health. This strategic move strengthens

Sensitech’s cold chain monitoring and visibility solutions for the pharma and

life sciences industry. |

|

DHL Group |

DHL Group is one of the largest logistics

networks in the world, serving the life sciences sector, including vaccines

and biologics.

In March 2025, DHL acquired

CRYOPDP, strengthening DHL’s life sciences logistics. CRYOPDP focuses on

clinical trials, biopharma, and cell and gene shipments. |

|

GS1 |

GS1 issues Unique Device

Identification (UDI) barcodes to record data throughout the healthcare supply

chain. GS1 enables the precise and effective identification, collection and

sharing of the data required for vaccination administration. It improves the speed and

accuracy of data capture, enables clinical decision support, and improves

traceability and recall of medical products. Several vaccine and

biologics manufacturers in the European Union, Brazil, China, Egypt, Saudi

Arabia, Singapore, South Korea, Taiwan, Türkiye and the U.S. use the GS1

standards to comply with UDI requirements. |

|

UPS Healthcare |

UPS Healthcare offers UPS Premier,

a sensor-based logistics solution designed for critical healthcare products, alongside full cold-chain management services.

UPS acquired Frigo-Trans and BPL

in Germany during January 2025 to enhance its European cold-chain delivery

capabilities. The company announced its plan to acquire Andlauer Healthcare

Group (AHG) in Canada for $1.6 billion in April 2025 to enhance its temperature-controlled

logistics services. |

|

Cencora |

Cencora’s World Courier offers cryogenic, ultra-cold and

direct-to-patient services logistics.

World Courier shipped its

first 300,000 mpox vaccine doses to the Democratic Republic of Congo (DRC)

and Nigeria in September 2024 to fight the mpox outbreak across Africa. |

|

Envirotainer |

The company develops active

temperature-controlled air cargo containers (example, Releye® family) are

widely used for vaccines/biologics.

In February 2025, the company

launched Releye RKN (lighter, >130 hours autonomy transport solution) and

was recognized by the WHO 2025 vaccine shipping guidelines as an “Advanced

Active” solution. |

|

Controlant

|

The company offers a real-time

visibility platform, IoT devices, control-tower services, and has supported

Pfizer’s COVID-19 vaccine distribution.

In November 2024, the

company raised $35 million to scale market expansion in the digital

transformation of pharma supply chains. |

Growth Areas in Near Short-term (three to five years):

Conclusion:

Looking for Consulting & Advisory Projects