Dental 3D Printing Market

Expert guidance to accelerate your market and strategy decisions.

3D printing in dentistry involves the creation of dental items through additive manufacturing, using intraoral 3D scans to make aligners, dentures and crowns. The 3D printing process builds dental models of crowns, implants, braces, retainers, aligners and other dental products through exact layer-by-layer construction. Compared to more conventional methods like casting, sintering and machining, this technology provides a faster, more accurate and more efficient procedure.

Evolution

With the advent of stereolithography in 1986, 3D printing emerged in dentistry. Stereolithography (SLA) made it possible to produce extremely detailed resin models and prosthetics, paving the way for digital manufacturing in dentistry. Digital light processing (DLP), which was released shortly after in 1987, offered faster manufacturing by curing complete layers at once as opposed to SLA's point-by-point method. Fused deposition modeling (FDM) uses thermoplastic filaments. It became a simpler and more cost-effective alternative in the next decade. It was initially less precise than resin-based technologies, but it worked well for dental models and prototypes where high precision was not required. In the mid-1980s, selective laser sintering (SLS) emerged. While SLS has been more effective in processing fine metal powders with increased surface quality, SLA and DLP for dental applications have undergone significant improvements over time, driven by advancements in materials, printing precision and production s

Current Market Trends

The market for dental 3D printers is growing because people want customized dental care and cosmetic dentistry services, for which they are even willing to travel abroad. The price gap between the U.S., Indian and Hungarian dental services makes several procedures affordable at lower rates in these locations. Also, smile design or implant treatments in India can be up to 80% to 90% cheaper than in the U.S., while the production of orthodontic aligners costs only a few dollars per model when batch-printed. By comparison, crowns and surgical guides in developed markets remain more expensive due to the use of high-end printers and materials. The market for dental 3D printing technology is growing because developing countries can afford these devices, which enable fast production of precise crowns, models and guides. Market growth is driven by technological advancements and strategic alliances among market participants.

Key Developments:

- SprintRay and Ivoclar formed a partnership to develop digital denture solutions through their combined Pro 2 printer and Ivoclar resin materials, which resulted in enhanced operational efficiency and superior product quality. (May 2024)

- Asiga launched easy-switch crown kits for its Max and Ultra 3D printers in March 2025. These printers enable fast dental crown, bridge and appliance production using new biocompatible resins. The company enhanced its workflow software to achieve better automation, which optimizes design-to-production workflows to boost digital dentistry capabilities and enhance laboratory operational performance.

- The 3D Systems company launched the NextDent 300 MultiJet dental 3D printer for market availability in February 2025. The printer operates at high speed to produce 15 dental arches during a nine-hour period, allowing laboratories to reduce their production requirements. The company plans to launch multi-material solutions for night guards and direct-printed clear aligners in 2026 while working to enhance manufacturing speed and operational efficiency. (February 2025)

- Stratasys launched the DentaJet XL as its new dental 3D printer designed for large-scale dental laboratory operations. The printer provides quick operation speeds, large resin container capacity and minimal post-processing needs to enhance operational performance. The system provides a 90% reduction in labor costs and achieves a 67% decrease in production expenses for each item. (July 2024)

- 3D Systems brought the NextDent 300 MultiJet dental 3D printer to market. The printer operates at high speed to generate 15 dental arches within nine hours, enabling high-volume labs to reduce their production time. The company plans to release multi-material solutions for night guards and direct-printed clear aligners during 2026 while working to boost manufacturing speed and operational performance. (February 2025)

Company Offerings

|

Technology |

Company Offerings |

Use Cases |

|

Stereolithography

(SLA) |

Form Labs: Form Cure (2nd Generation) |

Resin dental print post-curing + Perfect for

aligner models, surgical guides, and diagnostic models after post-processing. needs to be handled manually; it is not

suitable for mass production. |

|

UnionTech: RSPro series |

(Orthodontic models plus implant models,

plus surgical guidelines) |

|

|

Kudo 3D: Titan series |

(Orthodontic models, surgical guides and

custom dental restorations) |

|

|

Digital Light

Processing (DLP)

|

Phrozen: Sonic Lumii |

(Temporary crowns plus alignment and

diagnostic models) |

|

Anycubic: Photon Mono X, Photon Ultra |

Comprehensive dental models, surgery manuals

and crowns. |

|

|

Piocreat 3D: D158, D150 |

Temporary crowns, orthodontic models, and diagnostic

models. Limited build volume; post-processing might

be necessary. |

|

|

Selective Laser

Sintering (SLS) |

EOS: P 110 Velocis |

Orthodontic equipment, surgical guides and

dental models. High operating costs and the need for

experienced operators. |

|

Sinterit: Lisa Pro,

Lisa X, Suzy |

Orthodontic equipment, surgical guides and

dental models. Limited selection of materials;

post-processing is necessary. |

|

|

Fused Deposition

Modeling (FDM)

|

Phrozen: Sonic Mighty Revo 16K, Sonic Mega 8Ks, Sonic Mighty 12K |

Manufacturing of instructional materials,

dentistry models, and prototypes. |

|

Elegoo: Neptune 4 Max |

Anatomical study models + prototypes for

educational purposes Lower resolution; limited material compatibility. |

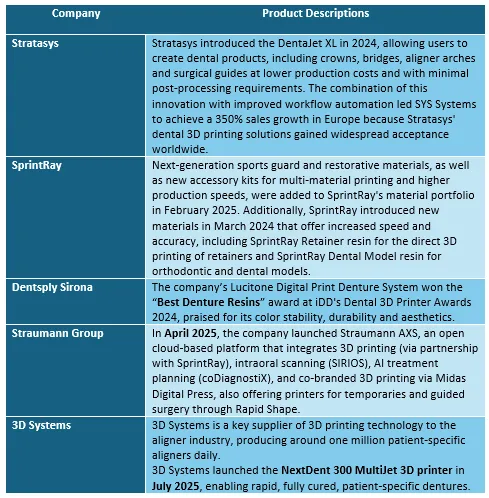

Key Market Players and Strategic Innovations

Future Outlook

The Straumann Group, along with Nobel Biocare and Cellink, conducts research into biomaterials and regenerative techniques to enhance oral healthcare outcomes. The dental industry benefits from 4D printing technology, which produces materials that change their structure and properties over time in response to specific triggers. The technology enables dental prosthetics and tissue-engineered models to be customized to match individual oral anatomy, resulting in superior patient comfort and functional outcomes. The organizations continue to develop 4D Ceramix and Stratasys adaptive material technologies, which show potential to revolutionize dental restorations and individualized treatments in future practice. The FDA will review 3D Systems' single-piece denture technology until 2025, with a projected approval during the second part of the year.

Conclusion

The development of dental 3D printing technology began with resin-based systems, including SLA and DLP, before moving on to create intricate surgical guides, crowns, and aligners. The dental industry is experiencing rapid global adoption due to the reduced costs in developing markets, as well as an increasing interest in dental restorations and cosmetic procedures among patients worldwide. Dental practices benefit from improved productivity, shorter treatment times and reduced costs through the combination of fast printers with specialized dental resins and digital workflows accessible through the cloud.

Looking for Consulting & Advisory Projects