Low-Carbon Fuels Market

January 19, 2026

Forecast-backed insights for confident investment decisions.

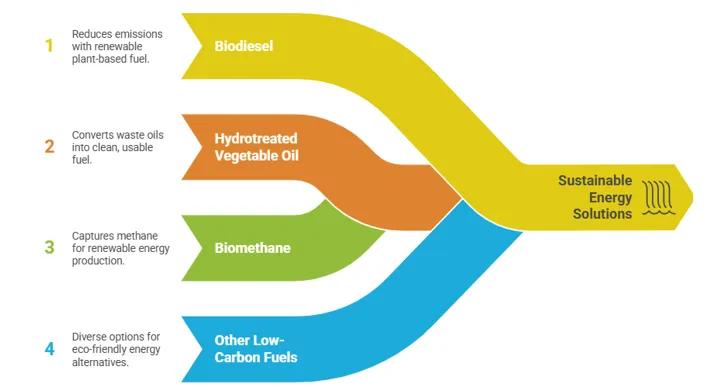

Low-carbon fuels are sustainable alternatives that emit less carbon dioxide (CO2) when burned than traditional fuels, thus helping reduce greenhouse gas emissions. This reduction is vital for improving air quality and addressing climate change. Some of the low-carbon fuels are natural gas, biogas, propane, renewable natural gas, compressed natural gas, liquefied natural gas and liquefied petroleum gas (LPG). Various methods, including natural gas extraction, biomass processing for biogas production and organic waste transformation into renewable natural gas, are widely employed to generate low-carbon fuels. Due to their extensive usage in power generation, transportation and residential heating, low-carbon fuels such as natural gas and LPG have attained widespread adoption. In 2023, the residential sector consumed approximately 14% of all natural gas in the U.S., while the electric-power sector consumed about 40% as per the U.S. Energy Information Administration (EIA). It states that natural gas is the primary energy source for space heating and electricity production.

Figure 1: Different Types of Low-Carbon Fuels

Market Scenario and Key Driving Forces

The overall demand for low-carbon fuels is driven by various factors, including energy security, tightening decarbonization regulations and increasing sustainability awareness, pushing the adoption of green diesel and sustainable aviation fuel (SAF). According to the World Economic Forum, the global demand for SAF is expected to reach 17 million tons per year by 2030, accounting for 4%– 5% of overall jet fuel use. This growth is fueled by rising airline commitments to net-zero targets and advances in technology that increase the efficiency and affordability of SAF production.

As per the European Union Aviation Safety Agency, in Europe, the ReFuelEU Aviation Regulation has imposed a minimum production requirement for SAFs, starting at 2% in 2025 and increasing to 70% by 2050. These regulatory initiatives are likely to boost investments and technological advances in low-carbon fuels, thus driving growth in the low-carbon fuels market and contributing to the shift toward carbon-free transportation and net-zero emission objectives.

Furthermore, power and utility end users are switching to low-carbon fuels such as green hydrogen, ammonia and biofuels to meet strict government goals such as the EU Green Deal and U.S. Inflation Reduction Act targets, making the grid more stable by combining variable renewables, and improving the overall energy security by using fewer fossil fuels. Additionally, to meet regulations on emissions and optimize energy efficiency, farmers are adopting low-carbon fuels, including biofuels and biogas. This lowers their reliance on fossil fuels for agricultural equipment and on-farm energy requirements. This shift is fueled by policies under programs such as India's National Bio-Energy Mission and the EU's Common Agricultural Policy, which incentivize climate-smart practices that include improving fertilizer effectiveness and using cover crops to reduce greenhouse gas emissions. Thus, growing demand from the power, utility and agricultural sectors is further driving the growth of the low-carbon fuels market. However, the low-carbon fuels market is hindered by high manufacturing costs and the limited availability of sustainable feedstocks.

Value Chain Analysis

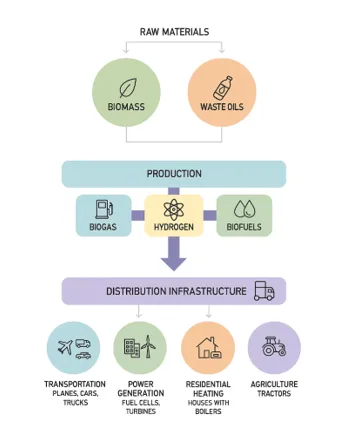

The first step in the value chain for low-carbon fuels starts with the procurement of environmentally friendly raw materials, such as biomass, waste oils and non-food crops. This helps limit environmental harm. Recycling atmospheric carbon through renewable raw materials reduces negative impacts while also cutting pollution and habitat loss associated with the fossil fuel extraction. Neste, Chevron and ENVIEN GROUP are some of the leading companies offering feedstock procurement services. These raw materials are processed into a variety of low-carbon fuels, such as biomethane, hydrogen, synthetic fuels and biofuels, by key manufacturers such as TotalEnergies, Shell plc, Repsol, LanzaTech and Gevo.

These low-carbon fuels are then supplied through existing or adapted infrastructure to end users across transportation, power generation and other sectors. The existing or adapted infrastructure includes pipelines, fuel stations and storage tanks that can be changed or used directly to safely and effectively handle low-carbon fuels. Major infrastructure and logistics providers include Royal Vopak, Air Liquide and ENGIE.

Technology companies such as Siemens Energy, Topsoe and Johnson Matthey create and streamline transportation, manufacturing procedures and blending methods across the value chain, while government organizations establish guidelines and incentives to promote sustainability. To ensure feedstock availability, quality of fuel, supply chain efficacy and market acceptance, cooperation between farmers, fuel producers, technology companies, distributors, legislators and consumers is crucial. With a focus on emission-intensive sectors such as aviation and heavy transportation, this integrated value chain facilitates the development of low-carbon fuels across various sectors, supporting the shift to a low-carbon and sustainable economy.

Figure 2: Value Chain of Low-Carbon Fuels

Key Manufacturers and Strategic Developments

Some of the key manufacturers operating in the low-carbon fuels market include Shell plc (the U.K.), Thyssenkrupp AG (Germany), Butamax Advanced Biofuels LLC (the U.S.), CropEnergies AG (Germany), Green Plains Inc. (the U.S.), Linde PLC (Ireland), Air Liquide (France), Iberdrola S.A. (Spain) and ENGIE (France).

In early 2023, the joint venture of Shell plc was announced with Vision Bioenergy Oilseeds (in partnership with S&W Seed Company). The collaboration aimed to use Camelina sativa and other rotational, non-food oilseed crops as feedstocks for producing renewable biofuels, such as renewable diesel and SAF. This initiative is likely to reduce emissions and promote agricultural sustainability by providing scalable, low-carbon substitutes for traditional fossil fuels across various industries. Additionally, Shell plc announced that it will be investing $10–15 billion in low-carbon energy solutions, including hydrogen, biofuels and other low-carbon fuels from 2023 to 2025.

Future Outlook

Strong growth opportunities lie ahead for the global low-carbon fuels market, driven by ongoing developments and legislative frameworks targeted at pushing demand and lowering production costs. Low-carbon fuels are predicted to play a critical role in accomplishing net-zero emissions by providing cleaner alternatives to fossil fuels. They will enhance energy security and support the shift to a cleaner, circular energy economy spanning various sectors such as residential and commercial heating, transportation, agriculture, and power generation worldwide. According to The Clean Energy Finance Corporation, Australia has a $36 billion opportunity to reduce emissions by 230 million tons by 2050, establish a world-leading low-carbon liquid fuel industry, and reduce its reliance on imported fuels. For industries where electrification is challenging, such as mining, heavy freight, aviation and defense, low-carbon fuels offer significant benefits. This transition would help Australia reach its net zero goal.

Conclusion

The global market is expected to benefit as global initiatives targeted at decarbonizing energy-intensive sectors, such as heavy industry and transportation, intensify. Low-carbon fuels such as advanced biofuels and synthetic e-fuels are widely recognized as a crucial element for industries that are difficult to electrify. Ongoing research efforts focus on improving manufacturing processes to make them more scalable and cost-effective. Key technological developments in processes, such as modular scaling technologies, advanced reactors, and CO₂-utilization and synthetic fuel pathways, are further paving the way for the market's promising growth. Thus, the overall market is likely to witness widespread adoption driven by increasing government support, corporate sustainability commitments and infrastructural investments in the coming years.

Looking for Consulting & Advisory Projects

BCC Research Beacon