Smart Workplaces: The Next Chapter of Work

Clear insight into competitor positioning and market share.

A workspace is no longer merely a physical structure. Since the COVID-19 pandemic, the concept of a workplace has transformed into a flexible combination of experiences—part home, part hub and part digital platform. Intelligent workplaces integrate these elements using sensors, analytics and building automation, with a focus on people-first design. This article outlines the factors currently motivating smart workplaces, the actual figures related to adoption, the practical challenges encountered by smaller businesses and how public funding and market potential are directing investments.

Why "Smart Workplaces" Matter Now?

There are three major factors that have pushed intelligent workplaces from "nice-to-have" to a strategic priority:

Hybrid work has gone mainstream: Following the pandemic, most jobs have remained partly remote. According to the Bureau of Labor Statistics in the U.S., the percentage of workers aged 25 and above who telework increased significantly to 24.9% from 21.5% in the same period a year prior, and the composition shifted toward more individuals teleworking some of their hours instead of being remote full-time. This represents a structural shift, requiring workplaces to accommodate flexible, on-demand use rather than assigned desks.

Climate and grid pressures: Governments and companies are eager for buildings to be energy-smart and grid-interactive. Smart controls, networked thermostats and load-management technologies can save energy and enable buildings to respond to grid requirements, a massive lever in national decarbonization efforts. The U.S. Department of Energy and Energy Star programs are already promoting grid-interactive, efficient buildings and smart energy management technologies.

AI + sensors + analytics: Generative AI and pervasive edge analytics enable the easier transformation of raw sensor streams (occupancy, indoor air quality and energy consumption) into actionable policies, such as dynamic HVAC, desk scheduling and predictive maintenance that enhance comfort, health and operating expenses.

These forces make smart workplaces both an operational play (lower energy consumption and longer asset life) and a talent/brand play (flexible environments that attract and retain staff).

Stats That Matter (Post-COVID Adoption and Productivity)

Telework prevalence: According to reports by Oyster HR, 51% of US employees adopted a hybrid work schedule, with 28% working fully remotely and 21% working completely on-site, a persistent shift compared to pre-pandemic trends. The makeup also shifted: more individuals telework some hours than all hours.

Employee preferences: Surveys from nonprofit research organizations, such as Eagle Hill Consulting and the Public Sector Human Resources Association (PSHRA), agree that flexibility is now mostly expected by workers. By the end of 2024, approximately one-third of workers in tele-workable jobs reported having always employed work-from-home arrangements, while hybrid working arrangements were also quite common. The employees' demand signal is pressing, and employers can no longer afford to ignore it.

Productivity connections: The U.S. Bureau of Labor Statistics analysis finds a strong link between growth in remote work and aggregate factor productivity among industries; a numeric suggestion that flexible/smart workplace policies can yield productivity returns if implemented effectively.

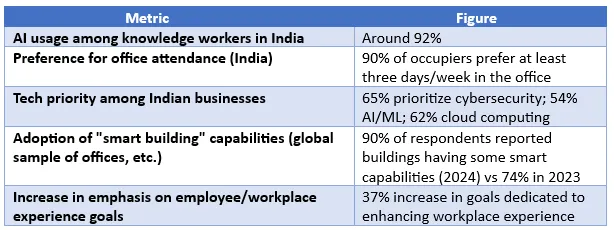

These numbers together paint a picture that smart capabilities are becoming increasingly widespread; AI is ingrained in work, and organizations are not merely tolerating hybrid work but redesigning around it. Technology, energy, sustainability and experience are top of mind.

Challenges and Issues for Smaller Organizations

Small offices and businesses are where adoption is weakest. Studies and government recommendations list persistent stumbling blocks. They face multiple issues, such as

Financing and initial costs: Smart systems, sensors and integration introduce capital cost; small and medium enterprises (SMEs) commonly cite costs and return on investment (ROI) uncertainty as prohibitors.

Operational disruption: Retrofitting may result in downtime or disruption of activities in existing buildings, such as the replacement of lighting and the installation of sensors, or even the reworking of HVAC ducting and controls. This process entails costs, logistics and scheduling. Without sufficient foresight, these become reasons for employee dissatisfaction or unbudgeted expenditures.

Vendor and skill complexity: Internet of Things (IoT) integration, data pipelines, and control require individuals with unconventional skills. SMEs often lack adequate internal capacity and face interoperability challenges in legacy building systems.

Cybersecurity and privacy: Networked devices extend attack surfaces. Government audits and warnings highlight the need for coordinated federal efforts and vendor best practices to minimize risk. Small businesses feel this pain deeply. The U.S. Small Business Administration identifies cyber risk as a significant concern for small businesses.

Regulatory and standards uncertainty: Although the EU is introducing a Smart Readiness Indicator (SRI) to rank building "intelligence," numerous markets lack clear evaluation frameworks, making it difficult for shoppers to compare vendors. That ambiguity decelerates buying.

Emerging Opportunities and Areas for Investment

Governments around the world are intensifying their roles amid rapid shifts in work practices, growing concerns about carbon emissions and higher expectations for healthy, technology-enabled built environments. By the end of 2025, public-sector initiatives will have largely transitioned beyond mere promotional activities for smart workplace technologies to actively promoting their mainstream acceptance. Governments now work through policy frameworks, funding programs and regulatory mandates to set forth clearer requirements on energy efficiency, data privacy and digital infrastructure. These public-sector forces help lower investment risk and costs while simultaneously establishing what qualifies as a bona fide "smart" and sustainable office.

Retrofit Smartization for Existing Building Stock

Most commercial buildings and offices are typically old structures, often dating back several decades. Retrofitting involves installing sensors, smart thermostats, occupancy detection and improved controls, which is more efficient and cost-effective than fully replacing the infrastructure. Such retrofit kits, featuring modular hardware, plug-and-play sensors and overlay software solutions that can integrate with legacy control systems, are attractive.

Managed, Subscription-based Smart Workplace Services

The so-called "hardware + software + maintenance + support (including cybersecurity)" bundles, with monthly/annual service agreements under which the customer pays, greatly reduce the risk for customers upfront. This, especially, attracts SMEs that want to enjoy benefits without the burden of capital investments or the need to hire staff of their own.

Health and Well-Being as Differentiators for Employee Experience

With contracting labor markets, employers can position physical space as a key brand asset. Smart workplaces are becoming attractive since they promise the well-being of occupants through better air quality, daylight, thermal comfort, flexible space and amenities (quiet zones, wellness rooms). It's these sensor features that should be promoted: CO2, volatile organic compounds (VOCs), humidity, daylight harvesting and adaptive lighting.

Energy and Grid Interactivity

As decarbonization is pushed by utilities and governments, buildings are being considered as part of the energy system (demand response, load flattening and storage). Workplaces that can modulate usage (HVAC, lighting) during peak periods, shift loads, or integrate with microgrids, solar, and battery systems, etc., will have new revenue/savings avenues.

Digital Twin, Simulation and Predictive Analytics

For large-scale complexes or campuses, digital twins (virtual models of buildings) enable the simulation of energy flows, occupancy and scenarios involving building modifications or emergency situations. Likewise, predictive maintenance (predicting when HVAC systems or lighting systems might fail) reduces downtime and expenses.

Scalable, Standardized Solutions and Interoperability

Solutions based on open standards or modular architectures that facilitate integration in demand. Similarly, any tool that helps end customers in evaluation and benchmarking (such as smart readiness indicators and indoor environmental quality (IE metrics) will help fill some identified knowledge gaps.

Financing and Incentive Instruments

These include green financing, energy performance contracts, tax credits and government incentives. Any funds aimed at de-risking investments (such as partial funding, performance-based grants) stand to move markets.

Recent Policy and Public-Sector Moves that Accelerate Adoption

Governments and public agencies are increasingly treating smart workplace technologies not as optional amenities, but as infrastructure with social, environmental and economic implications. Several high-impact policy shifts and interventions from 2024 to 2025 have transformed the perception from "incentivize" to "mandate, pilot and scale." Such moves provide clearer pathways and reduce friction for adoption by private organizations.

Given below are some of the notable developments in different countries.

The U.S.

Federal Smart Buildings Accelerator (U.S.): Run by the Federal Energy Management Program (FEMP) at DOE through 2024, the Federal Smart Buildings Accelerator offered technical assistance, facility assessments and education to federal agencies to support the adoption of smart building and grid-interactive technologies.

Enhanced design and construction standards for federal buildings (GSA, U.S.): The U.S. General Services Administration (GSA) updated its P100 Facilities Standards in August 2024 with more stringent design and performance criteria to the extent that design and construction of federal buildings now must be supportive of net-zero objectives, low-carbon materials and energy systems integration.

Tax Incentives & Energy Efficiency Deductions (U.S.): New IRS guidance in 2025 confirmed that Section 179D (commercial building energy efficiency deduction) remains available for projects commencing until mid-2026. Besides, incentives for high-efficiency home and building upgrades (e.g., insulation, HVAC and windows) as credits under Section 25C/45L will continue through 2025. Such guidance sets a fixed window for companies to act.

India

The Indian government's initiatives and ministries are promoting the adoption of digitization, the use of AI, upskilling and the enhancement of technology infrastructure. This strong adoption is tracked by Work Trend Index data (through IndiaAI), with many companies being encouraged or required to ramp up cybersecurity and AI/ML capabilities. In March 2025, the Government of India launched a Call for Proposals under the IndiaAI Mission to develop indigenous foundational AI models trained on Indian datasets.

The U.K.

The Future Homes Standard (2025) aims to establish standards for highly energy-efficient buildings, including low-carbon heating, among others. That will surely affect most workplaces, particularly those that are mixed-use or have live-work spaces.

Reports such as the Green Alliance's report "Smart Building: How digital technology can help futureproof the United Kingdom (U.K.) construction sector" suggest digital tools have enormous capacity to cut emissions from the construction industry through better design, reuse, and integration of smarter building technology, possibly as much as 40% by the end of 2025.

Additionally, in the U.S., there's an $80-million quantum (2024) trickle-down from the General Services Administration, going into the smart building industry, federal buildings in particular, regarding emissions reduction, energy efficiency and cost reduction for operations. A Nature Communications study has demonstrated that, depending on climate zone and building system, AI methods with intelligent control may reduce energy use and carbon emissions in the U.S. office buildings by 8%–19% by 2050, and even by 40%–90% in carbon emissions when combined with low-carbon policies against business-as-usual.

Regulations / Standards:

The European Union (EU) Smart Readiness Indicator (SRI) is being established in many member states to assess the level of "smart" of a building in terms of automation, adaptability and controls. This way, clients and occupants can compare options and thus incentivize the use of smart features.

Various countries' governments thus fund retrofitting, grants and tax incentives to upgrade energy controls, HVAC systems and IEQ sensors, among other measures.

Looking for Consulting & Advisory Projects