Wearable Biosensors: The Next-Generation Patient Monitoring Systems

Expert guidance to accelerate your market and strategy decisions.

Wearable biosensors are small devices that track and send continuous physiological and biochemical data originating from the human body. These wearable devices operate in real-time to monitor vital signs, including heart rate, blood oxygen levels, glucose and body temperature and check the body’s hydration status. Wearable biosensors offer medical-grade precision by directly connecting personal health information to healthcare systems, supporting both preventive medical care and immediate response interventions.

Significance

- The combination of cloud connectivity and Internet-of-Things (IoT) frameworks in wearable biosensors enables fast data collection and processing, which happens almost immediately. The system provides automatic data synchronization, which reduces manual tasks while delivering instant dashboards and automated summary reports to medical staff. The combination of these systems with artificial intelligence enables rapid pattern analysis, allowing doctors to make quicker decisions while improving operational efficiency and maintaining continuous access to valuable health information.

- The wearable devices integrate advanced AI and machine learning systems to automate data management, pattern detection and resource allocation for healthcare practitioners who can then focus on delivering treatment.

- Rising telemedicine expansion, digital transformation and rise in preventive and personalized care are propelling the demand for wearable biosensors in the clinical workflows, aiming to reduce healthcare costs.

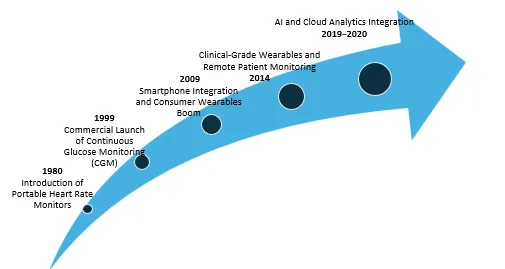

Evolution of Wearable Biosensors

Polar Electro launched the first commercial wearable biosensor for sports and health tracking in 1982.

The first FDA-approved Continuous Glucose Monitoring device, MiniMed, entered the market in 1990.

The market experienced widespread adoption after Apple, Fitbit and Garmin released wrist-worn electronics, introducing the first commercial wearable biosensors for sports and health tracking through their portable heart rate monitors, fitness trackers, which added smartphone connectivity and optical heart rate sensors and accelerometers to their devices in 2009.

The FDA started approving wearable ECG, SpO2 and arrhythmia monitoring devices for clinical use (2014), including products like Zio Patch by iRhythm and BioSticker by BioIntelliSense that integrate with telehealth systems.

In 2019, Philips HealthSuite, Current Health and other market players launched AI-powered wearable platforms that combine biosensor data with predictive analytics for hospital and home monitoring.

Current Market Scenario

Research and Development: Companies are investing in R&D to develop innovative wearable biosensors for remote patient monitoring. The partnership between GlucoModicum and Phillips-Medisize led to the development of Talisman, a continuous glucose monitor that operates without a needle. The device uses magnetohydrodynamic (MHD) technology and algorithms to collect data, which it then sends to a smartphone application for continuous monitoring.

Chronic Diseases and Remote Patient Monitoring Demand: Healthcare organizations are adopting remote patient monitoring (RPM) devices due to the increasing prevalence of chronic diseases, such as diabetes, cardiovascular problems and respiratory diseases. Real-time physiological data from wearable biosensors enables early intervention and reduces hospital readmission rates. In line with the increasing need for preventive, linked healthcare, BioIntelliSense's BioSticker and Abbott's Libre Sense, for instance, are being used for continuous monitoring in hospital-at-home programs and chronic care management.

COVID-19 outbreak: The wearable biosensor market experienced a boost from COVID-19 through its role as a catalyst, which led to technological progress, regulatory changes and clinical practice adoption. Philips Biosensor BX100 received USFDA 510(k) clearance for use at OLVG Hospital in the Netherlands to track COVID-19 patients under hospital care. The implementation of wearable biosensors throughout healthcare facilities has transformed patient care management in clinical and hospital environments. Healthcare practitioners adopt wearable biosensors because these devices help them save time while delivering precise data analysis results. The wearable biosensor market transitioned from experimental tools to standard clinical equipment because of increased research funding and rising demand for chronic disease management, digital transformation during COVID-19 and favorable payment structures. The market expansion results from both new product releases with advanced technology and strategic business moves made by industry leaders.

Recent Developments

- The company Trinity Biotech introduced CGM+, which represents an artificial intelligence-based continuous glucose monitoring system. The system tracks glucose levels and multiple health markers through wearable biosensors. The introduction of CGM+ represents a major step toward wearable biosensors becoming multi-sensor devices. The AI-native platforms unite clinical operations with consumer health needs to create better integration between medical practices and patient care. The device is in its final development phase, with commercial availability expected in the middle of 2026.

- Catapult introduced the Vector 8 athlete monitoring system in March 2025. Vector 8 is a wearable device that utilizes microprocessors and inertial sensors to monitor athlete performance and enhance healthcare procedures. It can be utilized for up to 120 athletes tracking across a 400-meter by 400-meter field.

- Dexcom launched one of the first FDA-approved over-the-counter glucose monitors called Stelo CGM (December 2024). It leverages Google Cloud’s Vertex AI and Gemini models. This glucose biosensing product offers personalized weekly insights based on glucose, sleep and activity data. Type 2 diabetics can use Stelo, a skin patch with a tiny needle that pierces the skin and is worn on the back of the arm for up to 15 days. It transmits glucose readings to a smartphone.

- Abbott launched Lingo in the U.K. in January 2024. It is a mobile software and biowearable gadget that promotes improved health and wellness. Users can get instant insights on their smartphones by using the Lingo app, which receives real-time data via Bluetooth from the tiny sensor worn on the upper arm. This sensor can continuously track important data, such as glucose dips and increases. To help people adopt healthier behaviors and pursue improved sleep, mood, focus, energy and reduced erratic cravings, the device will offer personalized insights and individualized coaching.

Growth Arena

The delivery of patient care through a structured sequence of healthcare provider tasks, decision points and processes constitutes clinical workflow in healthcare settings. The entire process of patient care encompasses all stages, from the initial arrival of patients until they receive a diagnosis and treatment, as well as subsequent monitoring, follow-up care and documentation. The implementation of wearable biosensors within clinical workflows enables better operational efficiency and allows for early patient intervention, leading to improved treatment outcomes.

Key Growth Areas:

- Multi-Modal Vital Sign and Physiologic Monitoring: The devices track heart rate and respiration rate, skin temperature, oxygen saturation, motion/accelerometry and biochemical signals (e.g., glucose, lactate) for 24/7 monitoring. The combination of multiple sensors in these devices enables more accurate trend analysis and improved detection of initial clinical decline.

- Digital Biomarkers and Remote Endpoints for Clinical Trials: The use of wearable-derived metrics, such as activity, sleep quality, gait and heart rhythm variability, enables trials to use quantifiable endpoints, which support decentralized/virtual trials and continuous measurement and patient-centered results.

- Remote Patient Monitoring and Chronic Care Management: Wearables used in home care settings for monitoring chronic conditions (like heart failure, COPD, diabetes, hypertension) and post-operative recovery to reduce rehospitalization or complications, support telehealth and shift more care outside hospitals.

Key Takeaways

The wearable biosensor market faces significant obstacles due to restricted EHR system integration, high technology costs, regulatory challenges and security risks associated with patient data. AI-powered platforms, remote monitoring programs and supportive reimbursement policies have enhanced real-time care and hospital-home connectivity. The future of clinical applications is expanding through upcoming technologies, including multi-sensor devices, predictive AI insights and non-invasive monitoring systems. The adoption rate receives additional support from the fast implementation of standardized regulations. Overall, the market is shifting rapidly toward smarter, more integrated patient monitoring solutions.

Looking for Consulting & Advisory Projects