Wind Energy Industry to Reach $250 Billion in 2020; Leverage in Government Subsidies Helping in Undertaking New Initiatives

March 13, 2015

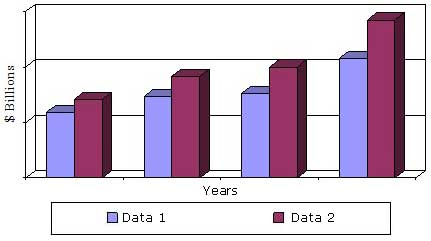

Wellesley, Mass., March 13, 2015 –BCC Research (www.bccresearch.com) reveals in its new report on wind energy, the usage has been growing and expanding to new regions worldwide. Globally, total investments in small wind, onshore wind and offshore wind energy reached about $130 billion at the end of 2013 and these investments are expected to reach $250 billion in 2020. These investments are inclusive of the basic cost of all types of wind turbines put together.

Wind energy is a reliable source of generating renewable energy, and has been established as one of the most preferred methods for generating renewable energy in several nations. The wind energy industry can be broadly classified into onshore and offshore. The former technology has achieved a certain degree of maturity, though costs can be reduced through material diversification and technology innovation. The latter, on the other hand, has the potential to deliver the greatest benefits and is anticipated to take off in the near future.

Asia-Pacific is the major market in the onshore wind energy sector, with China and India spearheading growth in the region. Government subsidies and wind energy targets are some of the factors driving investments in the onshore wind energy industry. Europe was once a major center for onshore wind development, but the region is still reeling from the economic crisis. Capacity installations are likely to pick up as the economy recovers further. Brazil is predicted to be an attractive market for wind power developers in Latin America. The onshore wind energy industries in Argentina and Costa Rica have exhibited promising development.

“Wind energy has great potential to lessen our dependence on traditional resources like oil, gas and coal, and to do it without as much damage to the environment,” says BCC Research energy and resources analyst Srinivasa Rajaram. “With largely untapped wind energy resources around the globe and declining wind energy costs, the world is now moving forward with an aggressive initiative to accelerate the progress of wind technology, and further reduce its costs, to create new jobs and to improve environmental quality.”

Being capital intensive, wind energy has no fuel costs. The price of wind power is therefore much more stable than the volatile prices of fossil fuel sources. There are now longer and lighter wind turbine blades, improvements in turbine performance and increased power generation efficiency. Compared with other low carbon power sources, wind turbines have some of the lowest global warming potential per unit of electrical energy generated.

Wind Energy: Global Markets measures and forecasts the global market for wind turbines and looks at the wind turbine installation and purchasing trends in some of the countries along with their growth potential. Revenue forecasts are provided through 2020.

Editors and reporters who wish to speak with the analyst should contact Steven Cumming at steven.cumming@bccresearch.com.

Wind Energy: Global Markets( EGY058B )

Publish Date: Feb 2015

Data and analysis extracted from this press release must be accompanied by a statement identifying BCC Research LLC as the source and publisher. For media inquiries, email press@bccresearch.com or visit www.bccresearch.com/media to request access to our library of market research.

BCC Library Membership Benefits

Unlimited Access to Market Research Reports for Academic Institutions and Corporations.

Custom Research

Tailored solutions across industries for your unique business needs.

More in Energy

- Solid Oxide Fuel Cells Market to Deliver Robust 24.4% CAGR by 2030

- Global Floating Offshore Wind Energy Market Expected to Surge with 60.1% CAGR by 2030

- White Hydrogen Takes the Spotlight as a New Clean Energy Powerhouse

- MENA Renewable Energy Market to Reach $59.9 Billion by 2030, Driving a Regional Green Energy Boom

- Electrical Switches Market Set for Strong Global Growth as Smart and Traditional Technologies Evolve

Reports from Energy

Recent News

- Global Pharmaceutical Filtration Market Projected to Achieve 11.1% CAGR Through 2030

- Powering the Future: Gas and Steam Turbine Market on the Rise

- Diesel Generator Market to Hit $31.8 Billion by 2030

- Precision Farming Market to Grow at 10.6% CAGR

- Hydrogen Pipeline Market to Grow at 19.3% CAGR by 2030